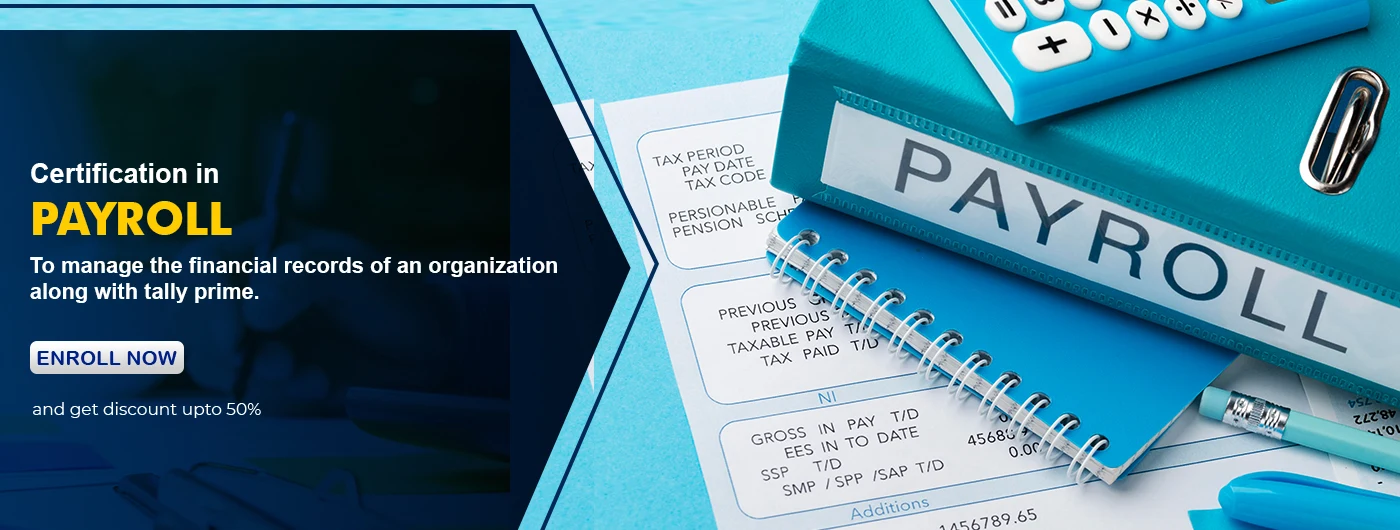

Every organization needs to manage its human resources for better growth. This course provides a deep detailed understanding of the payroll department and its functions. The payroll course will help you to collect data and control all the payroll expenses. You will be able to maintain the financial records on yearly bases which helps to increase the company value and employee performance. Payroll functions include dealing with financial aspects of an employee's salary, deduction, bonus, overtime, and net payment.

Payroll Course Highlights

1. |

Computation of salary |

2. |

Distributing salary to employees |

3. |

Generating MIS |

4. |

Filling statutory return |

5. |

5+ Live project |

6. |

26 Hours of training |

7. |

5+ Assignment |

8. |

1 Year free backup classes |

Payroll Course Learning Outcome

| • | You’ll be able to manage the financial record of an organization. |

| • | You’ll be able to manage the employee's salary, deduction, and funds. |

| • | You’ll be able to analyze the financial record of an organization and do forecasting for pre-hindrances regarding the finances and able to manage them accordingly. |

| • | Creating new salary records and modifications in the activities. |

| • | You’ll be able to work on ESI schemes, salary marking, Direct and indirect taxation IT, and income tax deduction. |

Software that you will learn in this course

Payroll Course Content

Jobs You will Get After Completing Payroll Course

All businesses have to look at the financial aspects of employees' salaries, bonuses, incentives, salary deductions, or managing the human resources on a monthly basis and have a record of monetary transactions, and for all the payroll activities they need a professional person who done this work efficiently and effectively. There are a lot of companies that hire HR payroll professionals who manage all the tax and finance activities for the effective management of an organization and they offer high salary packages to the professionals too.

| Job profile After completing this course |

Average salary ( 1+ year experience) |

|---|---|

| HR manager | 58k- 150k |

| Supervisors | 20k- 40k |

| Payroll clerk | 26k-30k |

| HR Specialist | 46k-116k |

| Payroll administrator | 36k- 68k |

| Payroll Data analyst | 32k-40k |

| Payroll Manager | 83k-167k |

| Payroll Director | 54k-92k |

Backup Class

Flexible Timing

Fees Installment

Expert Trainer

100% job assistance

Free Library

.webp)

Live Project

.webp)

Practical learning

Best computer training institute in kalka ji IFDA have very qualified teaching to nurture to students . Clear evey dout until to get teacher.over all IFDA in complete for accounting course.

It is the best institute in Delhi to get trained in IT field. I have learnt Accounting, Advance Excel and spoken english from this institute and i had a great experience. After completion of the course i can see my growth and also want to suggest you all to join this institute.

I am having a great experience in this institute. Here the faculty cover all the accounting topic. They teach you beyond the bookish language and give the overall knowledge of accounting. What makes this institute different from others is that they provide you with live data to practice on. This helps in real time problem solving.

0k +

0k +

0+

.webp)

0+

Frequently Asked Questions

A student who passed the 12th class is eligible to enroll in this HR payroll course and able to work on any organization after doing this course

If you will have any queries regarding payroll after completion of this course you can come to our IFDA institute and take a revision or doubt class from our experts and interact with them anytime.

Yes, if any student has an interest in the payroll process and income tax compliances can do an HR payroll course. Our expert will teach all the details and concepts about payroll and you will get to know all the knowledge about finance management

A payroll course provides you with a lot of career opportunities to learn new skills and abilities. In this field, you’ll get to know about different laws and regulations and implement those laws in a working environment. Payroll scope has rapidly increased over the last 25 years and continues to grow, helping manage employee time regulations, minimum wage modifications, RTI, SSP adjustment, SMP, SPP, and more.

IFDA is an ISO-certified computer training institute in Delhi, started in 2014. We offer various Government and Non-Government courses to aspiring students.

Yes, we offer online classes for students who are unable to attend in person due to distance or other reasons. Flexible batch timings and individual sessions are available to suit your convenience.

(1).webp)

(1).webp)

(1).webp)

(1).webp)

(1).webp)

(1).webp)

Get free counselling by our experience counsellors. We offer you free demo & trial classes to evaluate your eligibilty for the course.

Have you

Any question

Or need some help?

Please fill out the form below with your enquiry, and we will respond you as soon as possible.