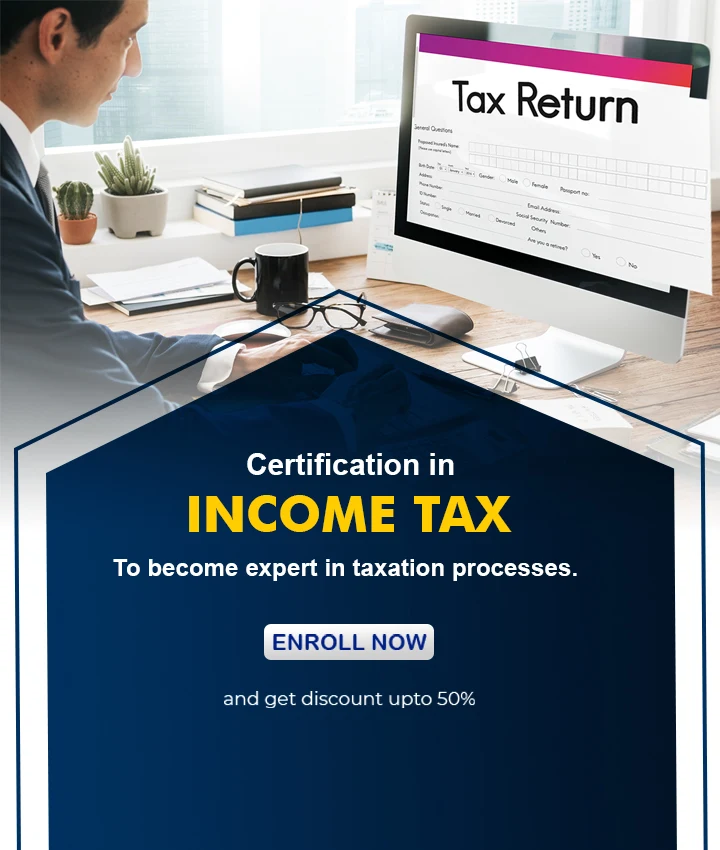

Income Tax is an e-filing course which has been designed for those students who wants to build their career in Finance and Accounts. Individual salaried or small businessmen can also do this course if they want to file the income tax return by themselves. This course will help you to calculate your income tax payable at the end of a particular period and also how to adjust your tax deducted at source (TDS). This course provides you practical training indirect taxation with expert and experienced trainers.

Income Tax Course Highlights

1. |

Different types of Taxes |

2. |

Maintaining GST and TDS file |

3. |

Computation of salary |

4. |

Filing income tax return |

5. |

30 hours of training |

6. |

5+ Live Projects |

7. |

10+ Assignments |

8. |

1 Year Free Backup Classes |

Income Tax Course Learning Outcome

| • | After completing this course, you will be able to do Tax planning and Tax management. |

| • | You’ll be able to calculate income from Capital Gains and other sources. |

| • | Learners will be able to file income tax returns. |

| • | You will be able to determine residential status and compute net taxable income of an individual. |

| • | You will be able to do direct taxation and tax collection. |

| • | To analyze and solve problems, using appropriate technology and accurate knowledge of software |

Income Tax Course Content

| • | Introduction |

| • | Direct Tax & Indirect Tax |

| • | Sources of Income Tax Law in India |

| • | Basic principles for charging Income Tax |

| • | Assessment Year | Previous Year | Assessee |

| • | Heads of Income |

| • | Income from Salary. |

| • | Income from Profits and Gains of Profession or Business. |

| • | Income from Capital Gains. |

| • | Income from Other Sources. |

| • | Gross Total Income (GTI) |

| • | Determination of Residential Status |

| • | Hindu Undivided Family (HUF) Company |

| • | Definition of Salary |

| • | Computation of Salary |

| • | Gratuity | Leave Salary Encashment |

| • | Perquisite | Leave Travel Concession |

| • | Provident Fund | Standard Deduction |

| • | Meaning of Business & Profession |

| • | Filing of Income tax returns |

Jobs You will Get After Completing Income Tax Course

Finance and Taxation courses have become one of the most career oriented courses as they cover all aspects of Financial planning, Investing, Accounting and Management. After completing this course, there is a lot of scope for you in the commerce industry. Today, recruiters are looking for dynamic and capable individuals who can efficiently handle all the financial work. There are immense job opportunities available in this field which help an individual to grab a lucrative job.

| Job profile After completing this course |

Average salary ( 1+ year experience) |

|---|---|

| Accounts Executive | 24k- 35k |

| Accounts Managers | 25k- 125k |

| Finance Managers | 108k- 250k |

| Banking | 80k- 583k |

| Tax Specialist | 54k- 133k |

| Finance Consultant | 53k- 72k |

| Auditor | 24k-40k |

Backup Class

Flexible Timing

Fees Installment

Expert Trainer

100% job assistance

Free Library

.webp)

Live Project

.webp)

Practical learning

I have a great experience in IFDA. The trainers are very supportive and explain every topic in detail. This Institute also provide backup classes on Saturday. I would like to suggest to join IFDA Institute to my friends and relatives. Thank u

I consider it very helpful because when when I first got into IFDA institute, it was very friendly and my knowledge in technology has gotten just not better but best. All the faculty here are very polite and ready to help whenever asked. Getting in this institute was my best decision.

Hello, My name is sarita,I'm student of IFDA institute. IFDA is the best computer training institute. Overall I love all the classes I have taken through IFDA institute,all the instructiors are kind and petient.They are very experienced in the program they are teaching.I have recommended this site to my school and friends. IFDA provides both practical and theoretical classes. Had a great experience here.☺️

0k +

0k +

0+

.webp)

0+

Frequently Asked Questions

Yes, we provide internship and placement opportunities to our students.

Yes, students who are not from commerce background can also pursue this course if they have completed class 12th from a recognised board.

The Income Tax course covers all the concepts related to taxes (including indirect & direct tax). As we know that whether it is a private or public institution both needs a professional who can handle the filing of tax returns and reports, so there will be a lot of career options for you after completing this course.

Yes, this course helps you in enhancing your knowledge of other taxes like GST, TDS, etc.

IFDA has emerged as the most encouraging & favorable institute in Delhi which is an ISO certified computer training institute ,started in the year of 2014. We provide various Govt. and Non Govt. Courses to all the desired students.

Yes we provide weekly classes or you can schedule your class according to your suitable time. We also provide online and backup classes so you can attend your missed or pending lectures.

(1).webp)

(1).webp)

(1).webp)

(1).webp)

(1).webp)

(1).webp)

Get free counselling by our experience counsellors. We offer you free demo & trial classes to evaluate your eligibilty for the course.

Have you

Any question

Or need some help?

Please fill out the form below with your enquiry, and we will respond you as soon as possible.